flow through entity taxation

Instead their owners or members include their allocated shares of profits in taxable income under the individual income tax. Pass-through businesses include sole proprietorships partnerships.

Pass Through Taxation What Small Business Owners Need To Know

A pass-through entity also known as flow-through entity is a business structure in which business income is treated as personal income of the owners.

. The revenue of pass-through entities. Generated by the entity filing this Form CT-225. In addition any disregarded entity wholly owned by an.

Instead the owners of the entity pay tax on their distributive share of the entitys taxable income even if no funds are distributed by the partnership to the owners. Federal tax law permits the owners of the entity to agree how the income of the entity will be allocated among them but requires that. Other reasons to consider a pass-through entity include the following.

The Guide to capital gains tax 2021 explains how capital gains tax CGT works and will help you calculate your net capital gain or net capital loss for 202021 so you can meet your CGT obligations. The tax liability is thereby passed onto the owners and the business income is only. The flow-through status of MLPs also holds on the state level meaning MLP investors are required to pay state income taxes on their allocated portion of income in each state in which the MLP operates.

The problems with finding some thread of principle through all the decisions basically stem from the false unity of the cases which while involving vastly different underlying issues are still linked under the metaphor of the veil As Blumberg writes the conceptual standards of entity law are frequently regarded as universal principles and applied. Guide to capital gains tax 2021 About this guide. CPAs must carefully evaluate whether electing PTE status for a flow-through entity would be beneficialthat is each PTE and its owners should weigh the benefits of making an irrevocable election to be taxed as a PTE comparing the savings in federal income taxes to any savings or costs at the state level.

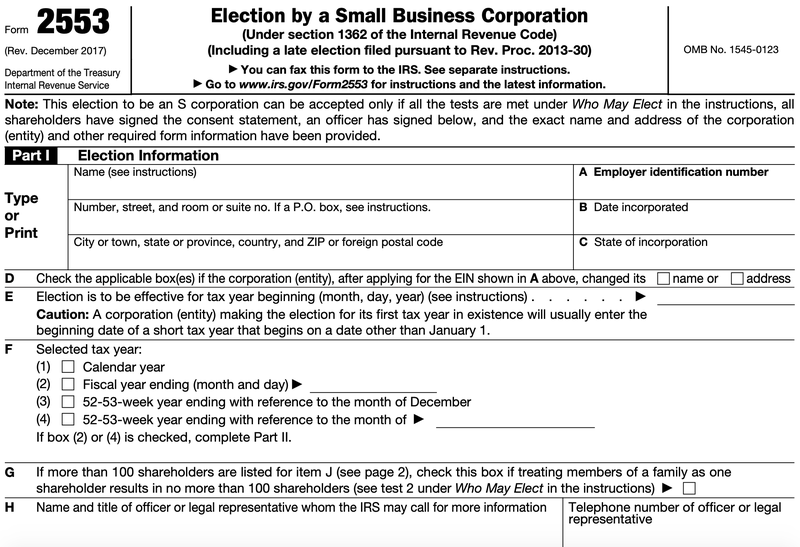

It is used to avoid double taxation when business income is subject to corporate tax and then to the owners personal income. This guide is not available in print or as a downloadable PDF. Paying taxes as an S-corp is a bit different.

An S-corp is a pass-through entity for tax purposes which means that shareholders report their share of the business income and losses on their personal tax return. Pass-through entities or flow-through entities. The corporation is entitled to a credit under.

There are links to worksheets in this guide to help you do this. Flow-through taxation means that the entity does not pay taxes on its income. By structuring their business as a pass-through entity the owners are only taxed once on business income.

When determining an entitys SGE status if one entity such as the test entity within the notional listed company group is an SGE then all. Owners only have to pay taxes once at their personal income tax ratethey arent subject to a corporate tax. You may have the same modification number listed.

Most US businesses are taxed as pass-through or flow-through entities that unlike C-corporations are not subject to the corporate income tax or any other entity-level tax. The notional listed company group identified with the test entity covers the group of entities that would have been required to be consolidated by the test entity as a single group for accounting purposes had the test entity been a listed company. In either Schedule A or Schedule B Part 2 use the modification number with the prefix of EA or ES to report that the filers share of these modifications flow through to the entity filing this Form CT-225 from a partnership estate or trust.

The pass-through entitys attributes will flow-through to the corporation that is the member of the pass-through entity and will be included in the entire net income of the corporation and that of the combined group and its receipts will be included in the combined group denominator and the corporations numerator of the allocation factor. Small businesses and start-ups often find double taxation cumbersome and unfair. Its important to note that some states do not require you to file state tax returns unless your gross income exceeds a certain amount which could reduce the number of.

9 Facts About Pass Through Businesses

Sole Proprietorships And Flow Through Entities Ppt Download

A Beginner S Guide To Pass Through Entities The Blueprint

Jp Magson Private Client Wealth Management

What Is A Pass Through Entity Definition Meaning Example

Pass Through Entity Definition Examples Advantages Disadvantages

Pass Through Entity Definition Examples Advantages Disadvantages

What Are The Tax Implications For An Llc Effects Of Operating As An Llc